DC Decumulation: Evolving the Pension Freedoms - Final Recommendations

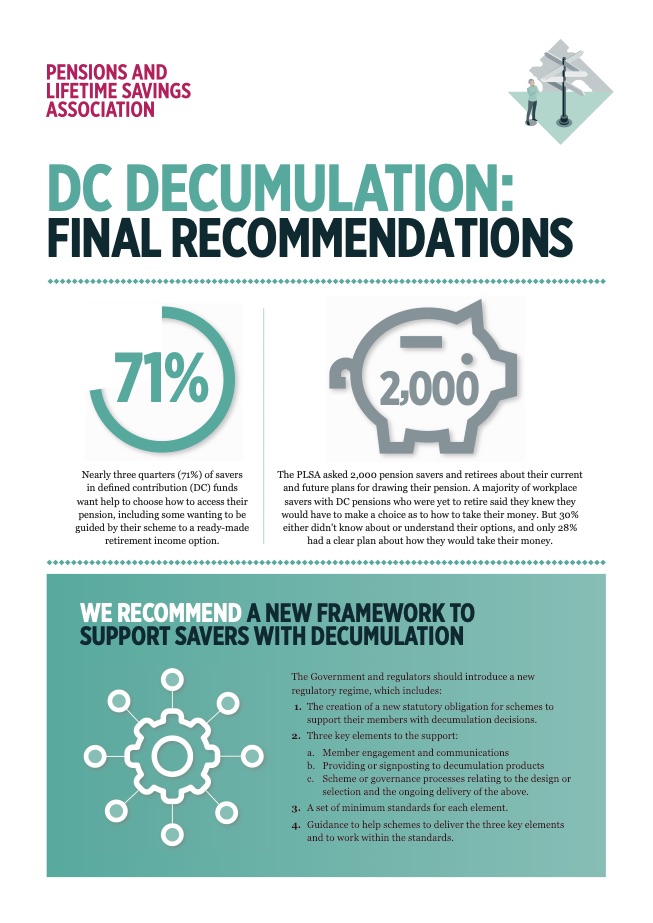

These final recommendations call for the establishment of a new regulatory framework to help savers with the complex decisions they face when choosing how to access their pension at retirement. The recommendation is being made following a three month consultation which set out the PLSA’s vision for a new Defined Contribution (DC) Decumulation framework in July. Having received widespread support, the final framework published today remains broadly unchanged, though some of the detail has been enhanced, refined, clarified and added to.

The key element for the framework is for schemes to support members by signposting them to a preferred product or solution, in the scheme or to another scheme – in order to help savers navigate the risks they face. We believe a new regulatory framework is the best way of mitigating the litigation risk that schemes face in acting in this space. The framework will also deliver a set of minimum standards for the saver communication and engagement journey as well as product design and governance.

This new framework is designed to meet several key objectives:

- To provide more support to savers who do not engage with their options - utilising the lessons from Automatic Enrolment and the Open Market Option – as well as supporting freedom and choice for those who do;

- To facilitate and influence future product development with a view to managing the risks for savers as Defined Contribution (DC) pots grow and dependency on DC derived incomes increases;

- To utilise the benefits of scale and mechanisms such as the trust-based fiduciary duty within Master Trusts and Trust-based schemes and the responsibilities of Independent Governance Committees (IGCs);

- To support similar saver experiences across the market, whilst enabling innovation to flourish;

- To mitigate or help manage some of the risks savers are facing; and

- To mitigate some of the key risks schemes are facing – including litigation, financial and operational risks.

This framework represents an evolution of the pension freedoms – enabling freedom and choice and providing the support savers need.