Adapting to a changing landscape

13 December 2022, Viewpoint

Reform is needed to ensure a brighter pensions future, says Nigel Peaple Director Policy & Advocacy, PLSA.

As 2022 draws to a close, it’s fair to say that it’s been a fairly turbulent year in UK politics. The fallout of the political upheaval – which has seen three Prime Ministers in post – has been widespread.

The pensions sector hasn’t been immune to this, and has experienced a fair share of uncertainty in recent months on top of the ongoing cost-of-living crisis. Yet the sector as a whole – and the PLSA – still remains committed to ensuring that savers are well placed to achieve a better income in retirement. But that ambition cannot come without suitable reforms being made at the highest levels of governance. To achieve this, the PLSA has recommended the government makes reforms to the UK pensions system.

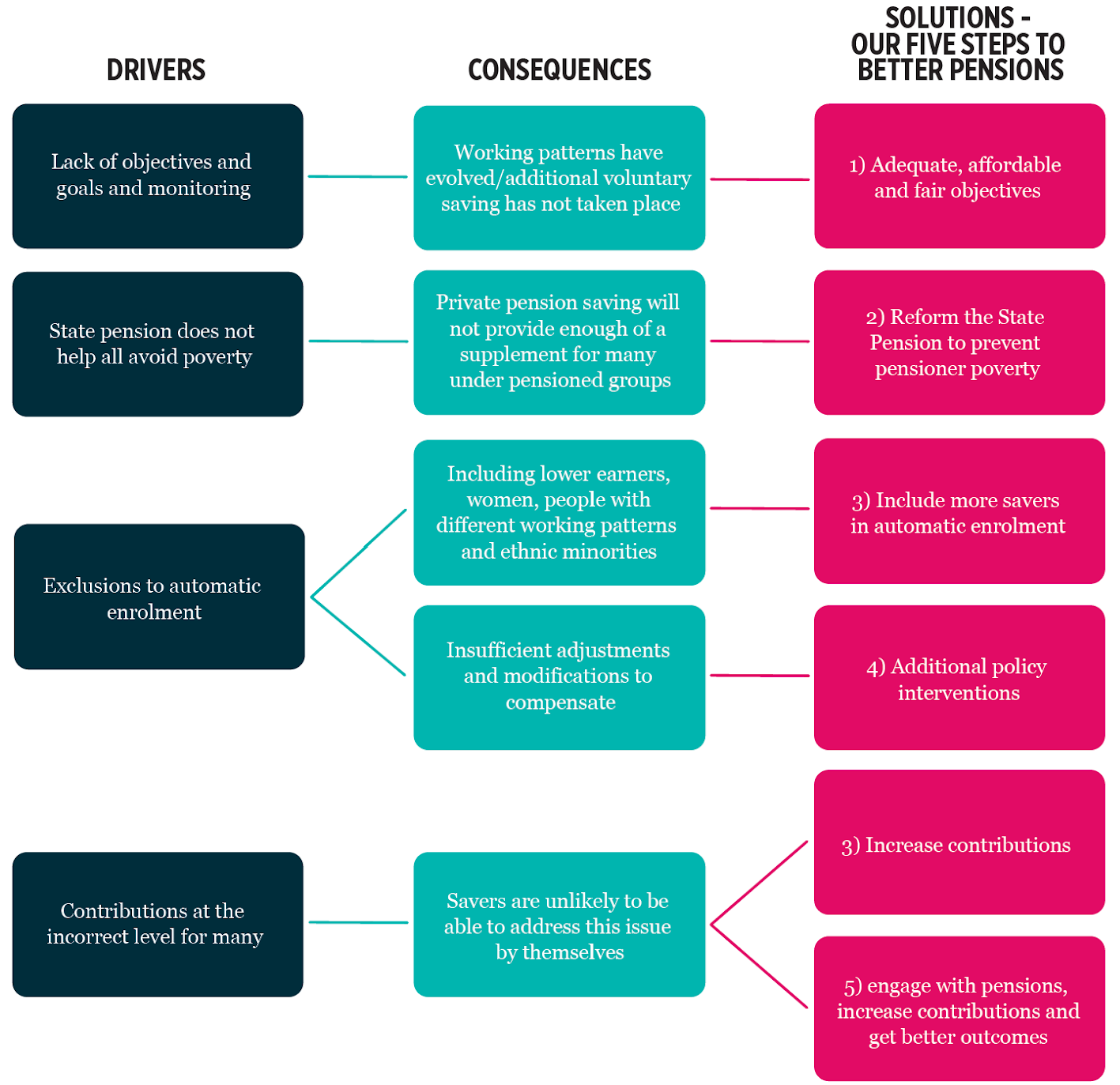

Drivers and solutions

Drivers and solutions

Why is reform needed?

In the 10 years since automatic enrolment was first introduced, the unprecedented success of the policy has become clear. Saver numbers are up significantly to 19.4 million, opt-outs are lower than expected, and evidence suggests people highly value pension savings and will continue to save in large numbers despite significant economic shocks, including the COVID-19 pandemic.

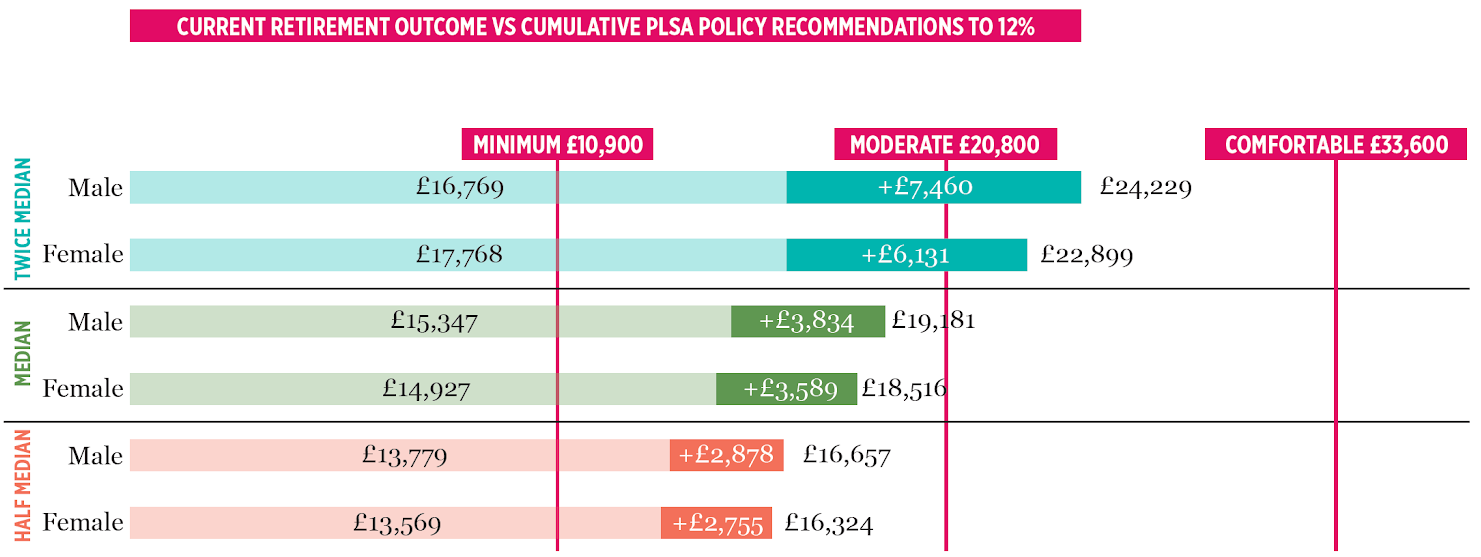

However, following research based on modelling by the Pensions Policy Institute (PPI), the PLSA finds that without reform, more than 50% of savers will fail to meet the retirement income targets set by the 2005 Pensions Commission (the Pensions Commission Replacement Rates).

This is true for people on average earnings, as well as for under-pensioned groups, such as people – often women – who take time out of work to care for others, and specific elements of the workforce such as the self-employed, gig-economy workers and people with part-time jobs. The research also found that around a fifth of households are likely to achieve less income than is needed to meet the ‘Minimum’ level of the independently assessed Retirement Living Standards.

This is why the PLSA published its report Five Steps to Better Pensions: Time for a New Consensus. In it the PLSA reviewed and assessed the current pensions framework and modelled the impact of a range of potential policy interventions, finding five key elements of reform that are needed to futureproof the pensions system.

What now?

There’s already broad agreement that evolution of automatic enrolment is needed. With that in mind, the PLSA’s recommendations can help form a new national consensus on how best to build upon a decade of automatic enrolment success so everyone can achieve the right income in retirement.

While we accept that now – in the middle of a cost-of-living crisis – is not the right time for radical changes, it is still prudent to provide a clear roadmap for reforms that will help to ensure better retirements.

What are the PLSA’s five reforms?

1. National objectives

The first change that is needed is the creation of clear national objectives for the UK pension system that are ‘adequate, affordable and fair’. This, combined with regular formal monitoring of whether it’s on track to achieve these goals, is key to future success for the sector.

2. State pension

The second is a reform of the state pension so everyone, at least, achieves the Minimum Retirement Living Standard, to prevent pensioner poverty.

3. Automatic enrolment reform

The PLSA also believes that reform is needed for automatic enrolment. We want to see more people reaping the benefits of saving into a workplace pension – and reforms to ensure more people are included, such as younger people, multiple job holders and gig-economy workers, will be vital to that. Also, at a higher level, we want to see changes to ensure that people on median earnings will be likely to achieve the Pensions Commission’s Target Replacement Rates. These measures include saving from the first pound of earnings, and gradually increasing contributions from 8% to 12% from the mid-2020s to the early 2030s, with contributions split evenly between employers and employees.

4. Support under-pensioned groups

Another change that we’d like is to see under-pensioned groups better supported. The PLSA believes that additional policy interventions are needed to help under-pensioned groups – including women, gig-economy workers and the self-employed as well as countless others –feel the benefits of being in a workplace pension scheme.

5. Industry initiatives to achieve better pensions

Finally, the PLSA wants to see more industry initiatives in place to help achieve better pensions. These could include actions to help people engage with pensions, receive higher contributions, or get better pension outcomes.

Download the full report here.