The Pensions and Lifetime Savings Association (PLSA) has published new research analysing the incomes different UK generations can expect in retirement. ‘Retirement Income Adequacy: Generation by Generation’ reveals that automatic enrolment will deliver a real improvement in the retirement outcomes of millions of people in the UK, but there is still room for improvement. Of the 25.5 million people in employment:

· 1.6 million people, are still at high risk of falling short of a minimum income standard1 (MIS) in retirement; and

· 13.6 million people, are still at risk of not meeting their target replacement rate1 (TRR).

Graham Vidler, Director of External Affairs, Pensions and Lifetime Savings Association, commented:

“Automatic enrolment is set to deliver a tangible improvement in the retirement incomes of millions of people but there is still work to do. For younger savers increasing their automatic enrolment contributions from 8% to 12% and working slightly longer puts them on track for their target replacement rate. For older workers, who have less time to save, achieving their target replacement rate may also require a choice to save more and using other assets, such as property, if they have them.

“It is clear from our analysis that minimum contributions under automatic enrolment need to increase to at least 12%. The precise level, the timing of the change and the balance between employer and employee contributions are issues which need to be fully thought through in the light of the effects of increases in contributions due in 2018 and 2019. The 2017 review is an opportunity to start working towards this next phase of automatic enrolment. The success of automatic enrolment to date has been underpinned by wide consensus and support as established by the Pension Commission. To ensure the next phase of automatic enrolment builds on this success the Government should begin by creating an independent commission.”

John Taylor, Partner at Hymans Robertson, added:

“We agree that increasing auto-enrolment minimum contributions is the right thing to do, but only once the tabled increases have bedded down. If we go too fast we run the risk of undermining support amongst employees and employers.

“The policy decisions needed to improve retirement incomes are far from simple and require careful consideration, with the challenge so substantial that progress needs to be achieved over decades. Unfortunately, the temptations of the electoral cycle can compromise long-term strategy.

“Fortunately there are steps that can be taken in the workplace to improve outcomes for employees without waiting for policy interventions - particularly for those who have time to make up the shortfall. There is strong evidence that new forms of engaging staff with savings can deliver good results. Employers who have the resource and appetite to improve employee outcomes can do so without waiting for policy interventions from government.”

The PLSA recommends the remit of an independent pension commission should cover three areas.

1. Review existing measures of adequacy and make recommendations for a national standard, or standards, which reflect the changing nature of retirement.

2. Make recommendations for increasing minimum contribution levels to at least 12% of qualifying earnings, including how and when this change should be made, and how it should be divided between worker and employer contributions.

3. Make additional recommendations to improve the situation of older savers who have less time to benefit from an increase in contribution rates.

Millennials: the automatic enrolment generation

This generation will be the first to experience the UK pension system as intended by the reforms of the last decade – the full basic state pension and saving over a full working life through automatic enrolment – but for those in a defined contribution scheme it won’t be enough to get them to a TRR. For them to achieve a TRR they will need higher pension contributions and to work slightly longer. (See notes to editors for case study models.)

Generation X: the in-between generation

This generation is caught in between the slow decline of defined benefit pensions and the roll-out of automatic enrolment. Many in this generation did not save into a pension during their early working lives and are now saving at a low level through automatic enrolment. Consequently the jump to achieving TRR is greater for this group than for the millennial group. Increasing pension contributions alone is unlikely to close the gap for this generation – they may need to work longer and utilise other assets, such as property, to generate a higher retirement income. (See notes to editors for case study models.)

Baby Boomers: the have and have not generation

Of Baby Boomers who are still working, those who have accrued defined benefit pension entitlement have very good retirement income prospects, but others face a comparatively poor income in retirement. Those without defined benefit may come to retirement with ten years or less of pension saving through automatic enrolment meaning they will be mostly dependent on the State Pension. For this group, working later is likely to make a real difference – providing an opportunity to increase the amount they have saved while at the same time decreasing the time they will be dependent on a retirement income. Positively, the majority of this generation has some property wealth which it may be able to use to generate an income in retirement. (See notes to editors for case study models.)

A pdf of the report ‘Retirement Income Adequacy: Generation by Generation’ is available here. The PLSA worked in collaboration with Hymans Robertson using their Guided Outcomes methodology®.

-Ends-

NOTES TO EDITORS

We’re the Pensions and Lifetime Savings Association; the national association with a ninety year history of helping pension professionals run better pension schemes. Our members include over 1,300 pension schemes with 20 million members and £1 trillion in assets, and over 400 businesses. They make us the voice for pensions and lifetime savings in Westminster, Whitehall and Brussels.

Our purpose is simple: to help everyone to achieve a better income in retirement. We work to get more money into retirement savings, to get more value out of those savings and to build the confidence and understanding of savers.

FOOTNOTE 1

We adopted two commonly used definitions of adequacy for the purposes of this report:

- Pensions Commission’s TRR: for an individual earning a median income of £27,456 the replacement rate of 67% equates to a retirement income of £18,395.

- Joseph Rowntree Foundation’s MIS which would require an income of £9,500 (in 2016).

CASE STUDY MODELS

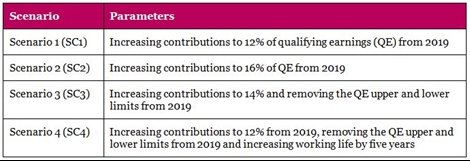

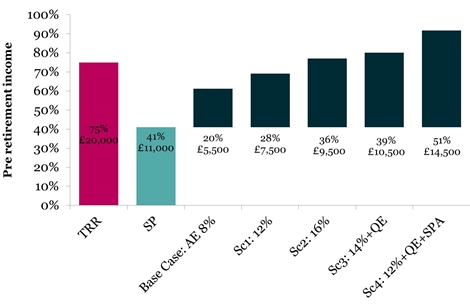

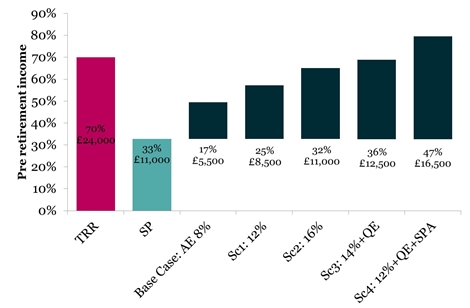

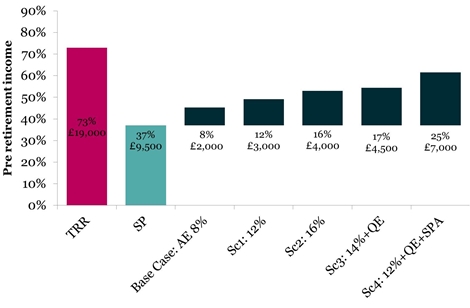

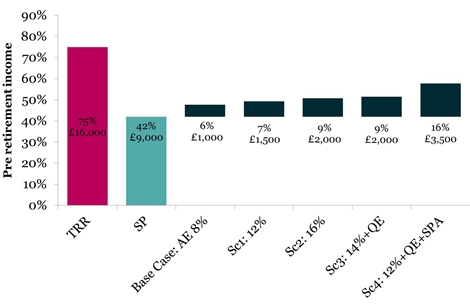

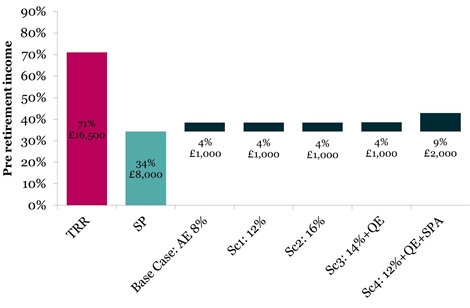

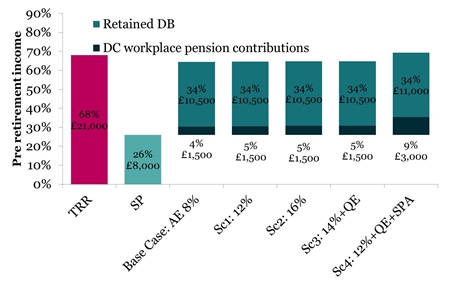

To address the shortfalls in projected retirement income we explored how a number of adjustments to the parameters of saving might alter the outcomes for those who are eligible for automatic enrolment (AE) in a DC workplace pension. The four scenarios were as follows:

For the case studies below, all £ figures are based on projected salaries at retirement, expressed in today’s prices, and have been rounded to the nearest £500. For all individuals, income or earnings are assumed to have increased by 1% per annum.

Case study 1: median outcomes for a female millennial, age 28, earning £18k per annum and automatically enrolled into a DC workplace pension.

Case study 2: median outcomes for a male millennial, age 28 earning £23k per annum automatically enrolled into a DC workplace pension

Case study 3: median outcomes for a female in Generation X, age 40 earning £20k per annum automatically enrolled into a scheme with no pre-existing DC or DB savings.

Case study 4: median outcomes for a female in Generation X, age 50 earning £18k per annum, automatically enrolled into a scheme and with a pre-existing DC pot valued at approximately £5,000.

Case study 5: median outcomes for a male Baby Boomer, age 59, earning £22k per annum, who is automatically enrolled into a DC workplace pension but also has some pre-existing DC savings valued at approximately £23,000.

Case study 6: median outcomes for a male Baby Boomer, age 58, earning £29k per annum, who has already acquired some pre-existing DC savings valued at approximately £17,000 and has also acquired some retained DB over the course of his working life.

Methodology

Our modelling has been undertaking using the Hymans Robertson’s Guided Outcomes ® methodology, a stochastic model which allowed us to project pension accrual to the point of retirement. Our data inputs for the model were taken from a segmentation analysis of the Wealth and Assets Survey (WAS) undertaken by the Pension Policy Institute (PPI) on individuals in employment aged 22 – 64. For more information on the Wealth and Assets Survey and limitations of this data source please see here.

For our full methodology, and detail of key assumptions used in the model, please see p19 – 23 of the report.

CONTACTS

Lucy Grubb, Head of Media and PR, Pensions and Lifetime Savings Association

T: 020 7601 1726, M: 07713 073 023, E: [email protected]

Babak Mayamey, Press Officer, Pensions and Lifetime Savings Association

T: 020 7601 1718, M: 07825 171 446, E: [email protected]

Kathryn Mortimer, Press Officer, Pensions and Lifetime Savings Association

T: 020 7601 1748, M: 07901 007 713, E: [email protected]