H M Treasury’s consultation ‘Strengthening the incentive to save: a consultation on pensions tax relief’ closes on 30 September. To help inform the debate on the topic of pension taxation, the National Association of Pension Funds (NAPF) has issued a pension taxation myth buster.

Pension tax relief is money lost to the Exchequer forever. Wrong!

Pension tax relief could more accurately be described as pension tax deferred. In the current system savers don’t pay tax on their money when and while they save for a pension, but most do then pay tax on 75% of their pot as they come to spend it (at their marginal rate).

Changing the system will give the Exchequer more money. Wrong!

It’s impossible for anyone to compare models with certainty.

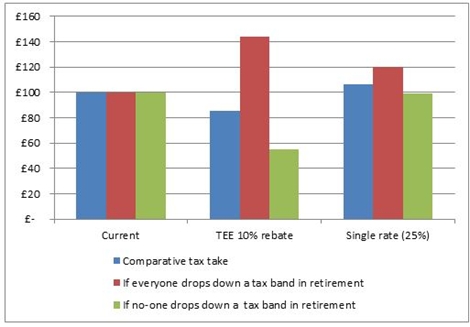

Modelling a central scenario – which assumes different proportions of contributions from different types of taxpayer both before and after retirement – the tax take for TEE (taxed, exempt, exempt) would be 15% less than the tax take under the current system EET (exempt, exempt, taxed) in net present value (NPV) terms. Using a similar scenario, the tax take from a 25% single rate of tax generates only slightly more than the current system.

Additionally, a change to TEE would require a high level of confidence that people will save more to offset both the loss of tax take to future Exchequers and ensure there is no increased pull on State resources from a growing retired population.

(See Note 1 in Notes to Editors for further details.)

High rate tax payers benefit disproportionately in the current system. Wrong!

Under the current system, pound for pound saved before tax, higher earners generally get a lower amount of pension to spend and pay more tax on their pension savings than lower earners.

Non-taxpayers and basic rate savers who drop a tax bracket in retirement do well out of the current system – which is effectively EEE (exempt, exempt, exempt) for them. They would lose from a shift to TEE but would be winners under a single rate of 25%.

(See Note 2 in Notes to Editors for further details.)

A single rate of relief would benefit the many at the expense of the few. Wrong!

It’s not that simple. A single rate which meets the Chancellor’s test of sustainability (i.e. costs less in terms of deferred income tax) would likely be set at 25% or lower.

This produces a relatively small additional benefit for basic rate taxpayers but would greatly reduce the attractiveness of pension saving for the 4.6 million higher rate taxpayers. And as those higher rate taxpayers, who currently meet a high proportion of pension schemes’ costs, reduce their pension savings everyone else ends up facing higher charges.

(See Note 2 in Notes to Editors for further details.)

Pensions tax relief is difficult to explain to savers. Wrong!

It’s pretty simple, in the context of automatic enrolment:

- You save £4, you get £4 - £1 back from the Government and £3 from your employer.

Changing the system will make it easier and cheaper to administer pensions. Wrong!

For both defined benefit (DB) and defined contribution (DC) schemes, a move to TEE will bring major changes to payroll for employers and effectively double the administrative burden for schemes. Member charges will rise as a result in DC schemes. DB schemes will face another major shake-up with inevitable closures.

It’s also likely to store up for the future some thorny legacy issues. A knock-on effect of practically doubling overnight the number of accounts or pots means it will be even more difficult to deliver the pensions passport and dashboard.

A move to single rate and TEE will require all DC schemes to move to relief at source, bringing with it massive changes to payroll for employers and significant additional cost. The cost of implementation for DB schemes will be even higher.

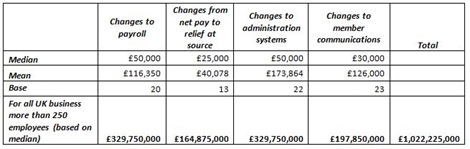

A survey of NAPF members estimates the median cost to a large employer of making the necessary changes to payroll would be £50,000. If replicated across all 6,595 employers with 250 or more employees [1] this would amount to almost a third of a billion pounds (£329,750,000).

(See Note 3 in Notes to Editors for further details.)

Workplace pension schemes will continue to contribute above the statutory minimum regardless of changes to the system. Wrong!

Our members tell us continued change to the system will force them to re-think their pension provision. If only the schemes who responded to the NAPF 2014 annual survey were to reduce their DC scheme contributions to the statutory minimum the loss to pension savings would be £2.3 billion per year, over £11 billion in one electoral term.

(See Note 4 in Notes to Editors for further details.)

A move to TEE requires savers to trust future governments not to tax retirement income, regardless of the wider fiscal picture. Is this feasible?

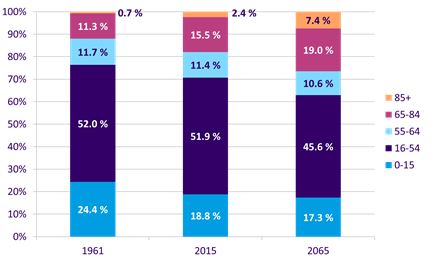

The Office for National Statistics (ONS) forecasts that as a proportion of the population there will be one and a half as many people aged 65 and over in the UK in 2065 compared to 2015.

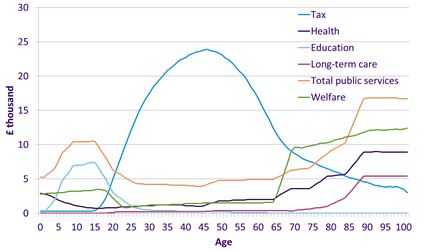

The Office for Budget Responsibility’s (OBR) mapping of Government spending and tax receipts over a lifetime indicates that currently the total call on public services starts to rise at the age of 65, increases sharply again at around 75 years of age and rises even further at around 85 years of age.

These two factors combined with a move to TEE now, which would reduce the tax contribution of pensioners in the future, put considerable pressure on the public purse and quite possibly will precipitate a future government’s move to TET (taxed, exempt, taxed).

(See Note 5 in Notes to Editors for further details.)

[1] BIS statistical release

ENDS

NOTE 1: comparative tax revenue in NPV terms

Key assumptions for the above chart:

- Growth rate for funds over 25 years = 6%

- Charges on fund = 0.5% (slightly higher than the average charge made by NAPF schemes but lower than the charge cap)

- Discount rate to arrive at NPV = 3.5% (long term rate used by HM Treasury)

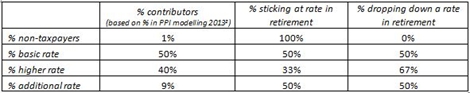

- Central scenario based on mix of taxpayers as per table below (percentage of contributors per tax band based on PPI analysis 2013, the percentage sticking at rate is based on NAPF assumptions).

[2] PPI Tax relief for pension saving in the UK, July 2013

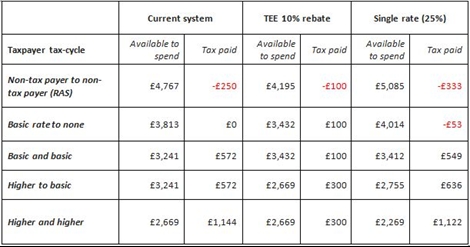

NOTE 2: Pension savings at retirement and tax contributions by different tax payers, modelled in three pension tax regimes

The tax contributions in the table below are based on £1,000 investment with a gross growth rate of 6%, less charges of 0.5%, invested for 25 years untouched and spent in retirement.

NOTE 3: Estimated costs to schemes of making changes to payroll, administrative and member communications

Source for cost estimates: NAPF member survey September 2015. The figures below based on multiplying the median cost by the number of UK businesses with over 250 employees (6,595) according to BIS Statistical Release of business population estimates for UK and regions 2013.

NOTE 4: Loss of employer contributions

Schemes responding to the 2014 NAPF annual survey had 2,300,000 active DC scheme members. Median gross annual income across all employees according to ASHE 2013 is £21,800. Statutory minimum employer contribution under automatic enrolment is 3%. Current average employer contribution to DC schemes by NAPF schemes responding to 2014 annual survey was 7.6%, giving a differential of 4.6%.

Therefore: active members (2.3m) x median income (£21.8k) x contribution differential (4.6%) = £2,306,440,000 per annum.

NOTE 5: The wider fiscal picture

Number of tax payers

Source: HMRC, , with projections to 2015-16. Projections: 24.7m basic (83.2%); 4.6m higher (15.6%); and, 332,000 additional (1.1%).

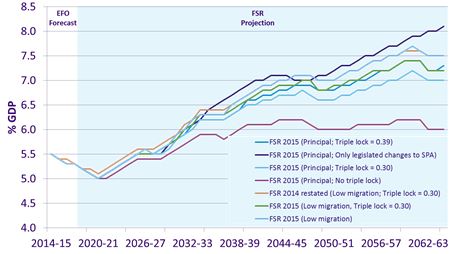

All the charts below are taken from the published by the Office for Budget Responsibility in June this year.

Growth in the UK’s older population

Long term state pension forecast

OBR mapping of Government spending and tax receipts over a lifetime

Contacts

Lucy Grubb, Head of Media and PR, NAPF, 020 7601 1726 or 07713 073023, [email protected]

Eleanor Carric, PR Manager, NAPF, 020 7601 1718 or 07825 171 446, [email protected]

Kathryn Mortimer, Press Officer, NAPF, 020 7601 1748 or 07901 007713, [email protected]